The 10-Second Trick For Warenty

Table of ContentsThings about WarentyOur Warenty StatementsFascination About WarentyWarenty Can Be Fun For Anyone

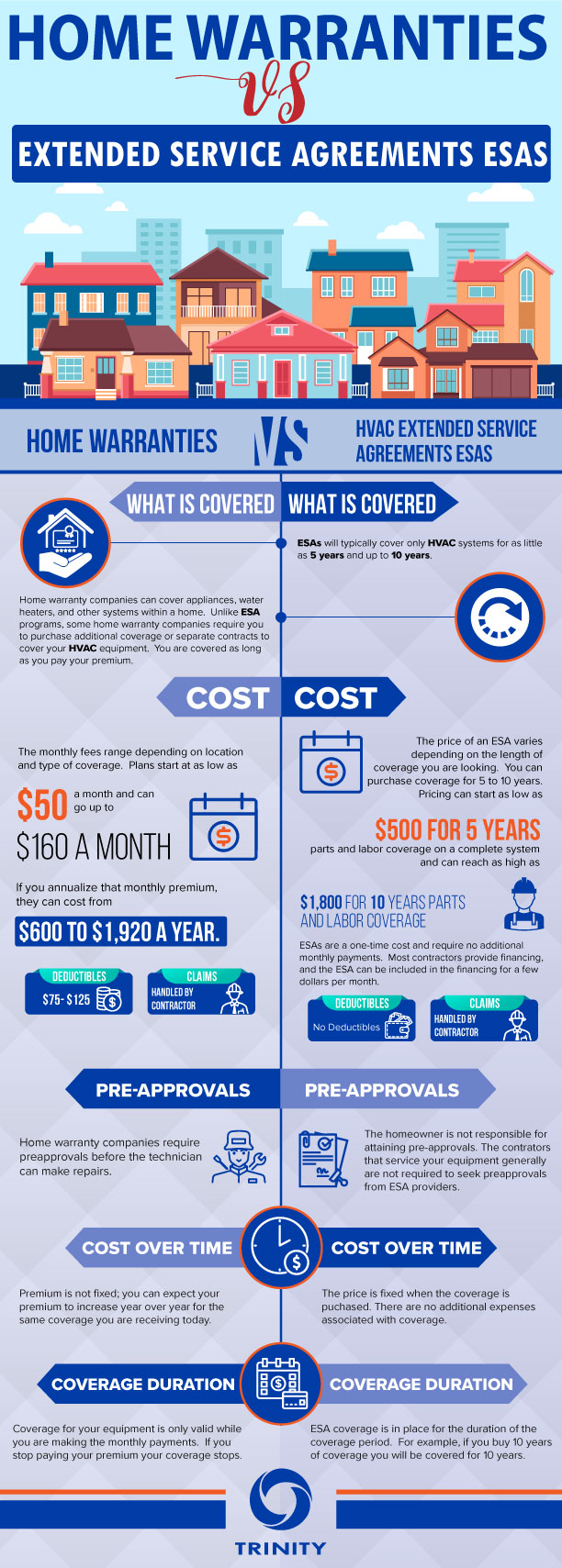

Property owners will normally need to pay an insurance deductible, a set quantity of cash that appears of the homeowner's wallet before the home insurer pays any type of money in the direction of the insurance claim. A house insurance coverage deductible can be anywhere in between $100 to $2,000. Generally, the greater the insurance deductible, the reduced the annual premium expense.

What is the Distinction In Between House Guarantee and Residence Insurance Policy A house guarantee contract and also a house insurance plan run in similar means. Both have an annual premium and also an insurance deductible, although a residence insurance policy costs and insurance deductible is typically a lot greater than a residence service warranty's. The major differences in between home warranties as well as house insurance are what they cover.

One more difference between a residence guarantee and also house insurance is that residence insurance coverage is generally needed for property owners (if they have a mortgage on their house) while a home guarantee plan is not needed. A home guarantee and house insurance policy supply defense on different components of a home, as well as with each other they can safeguard a homeowner's budget plan from pricey repair work when they certainly appear.

See This Report about Warenty

If there is damage done to the structure of your home, the proprietor will not have to pay the high expenses to fix it if they have residence insurance. If the damage to the home's structure or property owner's items was produced by a malfunctioning appliances or systems, a home guarantee can assist to cover the expensive repair services or substitute if the system or home appliance has stopped working from typical wear and tear.

They will work together to supply defense on every part of your house. If you're interested in buying a home guarantee for your house, have a look at Spots's residence service warranty strategies and also prices right here, or request a quote for your home below.

In a warm vendor's market where house buyers are waiving the residence inspection backup, acquiring a house warranty could be a balm for stress over prospective unknowns. To get one of the most out of a residence guarantee, it is necessary to read the great print so you recognize what's covered and news also exactly how the plan functions before joining.

The difference is that a house warranty covers an array of items instead than simply one. There are three standard kinds of residence guarantee strategies.

10 Simple Techniques For Warenty

Some items, like in-ground lawn sprinklers, swimming pools and septic systems, may call for an extra guarantee or could not more be covered by all residence warranty companies. When comparing house service warranty business, see to it the plan alternatives incorporate everything you 'd want covered.New building and construction residences typically included a service warranty from the builder.

Builder guarantees typically do not cover home appliances, though in a brand-new residence with brand name brand-new devices, suppliers' service warranties are most likely still in play. If you're obtaining a residence service warranty for a brand-new residence either brand-new building and construction or a residence that's brand-new to you protection normally starts when you close.

Simply put, if you're purchasing a house and an issue comes up during the residence examination or is kept in mind in the vendor's disclosures, your house guarantee company may not cover it. Instead of counting exclusively on a warranty, attempt to bargain with the vendor to either correct the issue or give you a debt to aid cover the expense of having it repaired.

You do not have to research as well as get referrals to find a tradesperson every single time you require something fixed. The other side of that is that you'll get whomever the residence guarantee firm sends out to do the evaluation and make the repair. You can not choose a service provider (or do the work on your own) and afterwards get compensated.

Examine This Report on Warenty

Your homeowners insurance policy, on the other hand, covers the unanticipated. It won't aid you replace your devices because they obtained old, but house owners insurance might help you get brand-new appliances if your existing ones are harmed in a fire or flooding. With property owners insurance policy, you'll have to satisfy a insurance deductible before the insurance firm starts spending for the price of your claim.

Exactly how much does a house service warranty price? Residence service warranties address generally cost between $300 and $600 per year; the cost will vary depending on the type of strategy you have.

, you will certainly pay a solution fee every time a tradesperson comes to your home to evaluate a concern (warenty). This charge can range from about $60 to $125 for each solution instance, making the service cost one more point to consider if you're going shopping for a house warranty strategy.